ace listing requirements

And b a principal officer of the listed corporation or its major subsidiary. Receive confirmation from Bursa Depository that By1200 the securities are ready for crediting.

What You Need To Know Listing At Bursa Malaysia Listing And The Requirements Hills Cheryl

Secure and maintain a Continuing Adviser for at least 3 years post listing and the Approved Adviser who submitted the listing application must act as the Continuing Adviser for at least 1 FY upon admission.

. These documents will be updated periodicallyACE Entry Summary Business ProcessACE Entry Summary Rejection Response. These documents contain the Main Market Listing Requirements which have been updated as at the date above and are posted on this website for the publics reference only. Requirements for ACE Access Certainty Efficiency market.

Amendments to the ACE Market Listing Requirements ACE LR in relation to Disclosure Other Obligations and Issuance of Corporate Disclosure Guide. Submit the share certificate together with a covering letter containing the summary of the By 1000 corporate proposal to Bursa Depository am. Engage an Approved Adviser to assess the suitability for listing.

First there is the suitability for listing issue. The ACE Entry Summary Instruction document provides entry summary field descriptions and data requirements. QUOTATION Secondary Issuance Under the simplified listing process the following procedures will be applicable.

The ACE Entry Summary Process document outlines the entry summary workflow in ACE. 3 Jan 2012 Appendix 2. Full Text of Amendments Disclosure Other Obligations Effective.

To see the answer to one of the questions listed below click the arrow next to that question. The Securities Commission Malaysia SC and Bursa Malaysia Securities Berhad the Exchange issued a joint media release on 20 December 2021 announcing amendments to the ACE Market Listing Requirements ACE LR to enable the. You should always refer to these Listing Requirements and Guidance Notes together with any subsequent amendments issued from time to time by Bursa Malaysia Securities Berhad.

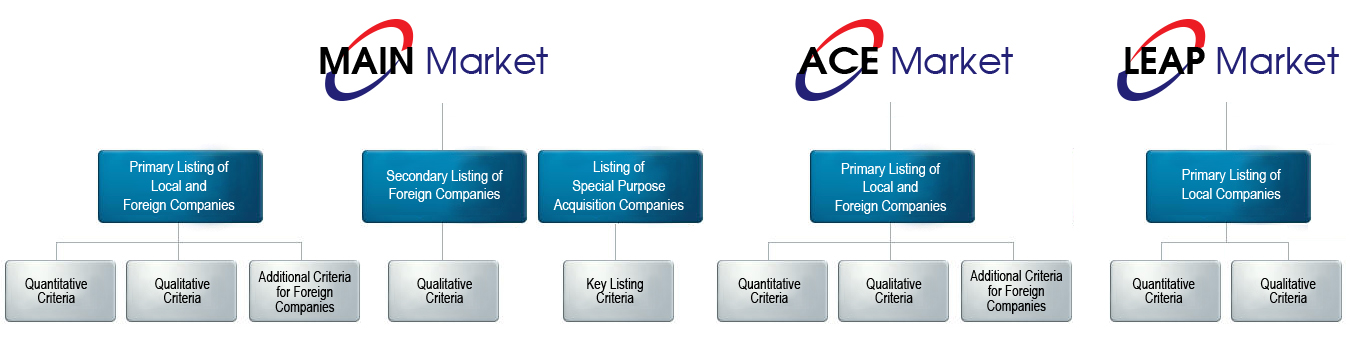

She also explained that unlike the MESDAQ Market the ACE Market allows listing of eligible companies from all sectors instead of only highgrowth or technologybased companies. The requirements in this Chapter apply to dealings in any listed securities by the following categories of persons collectively referred to as affected persons. Promoter and chief executive of an ACE Market applicant are responsible for disclosures made in a pre-admission consultation pack listing application and prospectus together with the applicant its directors and.

Independent market research report is optional for ACE Market listing application. In contrast investments in ACE Market counters are considered riskier due to the lower listing requirements. A a director of the listed corporation or its major subsidiary.

202 Objective of ACE Market 203 Purpose of these Requirements 204 General principles PART B APPLICATION OF THESE REQUIREMENTS 205 Obligation to comply 206 Spirit of these Requirements 207 Waivers and modifications 208 Varying or revoking decisions 209 Guidance Notes PART C DOCUMENTS TO COMPLY WITH THESE REQUIREMENTS. ACE Market corporations that have met the Main Market admission criteria. Please also see In-Bond Regulatory Changes Frequently Asked Questions.

And c the undertakings and confirmation by an applicant and its directors. ACE Market Listing Requirements AMLR. Various standards that are established by stock exchanges such as the NYSE to control membership in the exchange.

B the listing application form and supporting documents. No minimum operating track record or profit requirements. Welcome to the ACE FAQ page.

If you intend to have your company listed in the ACE Market there are several factors that must be considered. A the procedures for admission. If you dont see your question answered above please feel free to reach out to one of the support resources listed on our ACE Support page.

While there is no exact market rate for the listing status of a company most corporate observers estimate that the shell of an ACE Market company could easily be worth about RM5 million to RM10 million whereas a Main Market company could fetch. 1 This Chapter sets out the requirements that must be complied with by an applicant or a listed corporation as the case may be for any new issue of securities. These documents contain the ACE Market Listing Requirements which have been updated as at the date above and are posted on this website for the publics reference only.

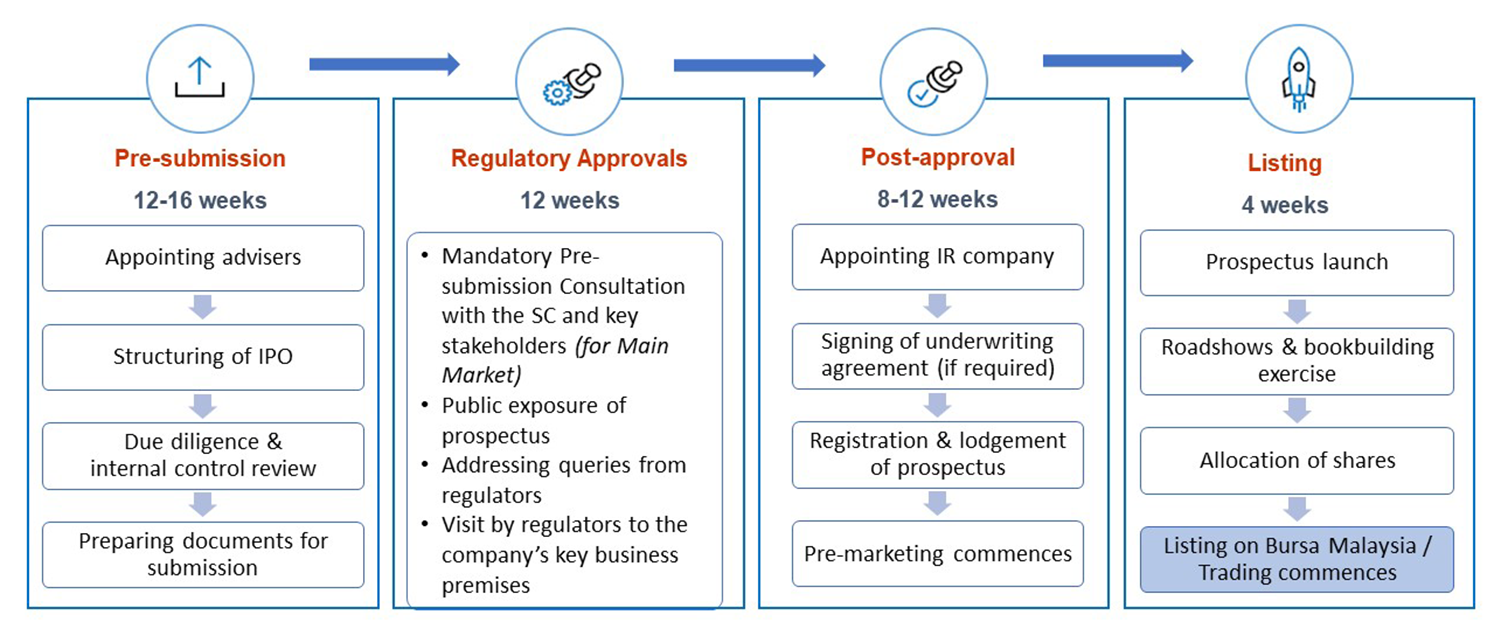

This is where Bursa Malaysia will rely on the Sponsor and then review the proposal of the company. 2 If the new issue of securities is pursuant to or will result in a significant change in the business direction or policy of a listed corporation the listed corporation must also comply with the. 1 Where any one of the percentage ratios of a transaction is 5 or more the listed corporation must announce the transaction to the Exchange as soon as possible after terms of.

Sponsorship is for one full FY. The company will need to issue a minimum of 25 of the companys shares to the public. This Guidance Note sets out the following requirements in relation to an application for admission under Rule 302 of the Listing Requirements.

There is no minimum requirement on the operating history size and. Companies wishing to issue their stock on a given exchange. Requirements for transactions with percentage ratio of 5 or more.

A Cash Company must place at least 90 of its cash and short-dated securities including existing cash balance and the consideration arising from the disposal undertaken by the Cash Company in an account opened with a financial institution licensed by Bank Negara Malaysia and operated by a custodian. Summary of Key Amendments Disclosure Other Obligations Effective. ACE Market Listing Requirements Amended to Facilitate One-Stop Centre for IPOs.

This is where the company. Listing requirements in the ACE Market. The company to have paid-up capital approximately RM 5 million to RM 10 million.

You should always refer to these Listing Requirements and Practice Notes together with any subsequent amendments issued from time to time by Bursa Malaysia Securities Berhad. 202 Objective of ACE Market 203 Purpose of these Requirements 204 General principles PART B APPLICATION OF THESE REQUIREMENTS 205 Obligation to comply 206 Spirit of these Requirements 207 Waivers and modifications 208 Varying or revoking decisions 209 Guidance Notes PART C DOCUMENTS TO COMPLY WITH THESE REQUIREMENTS.

Bursa Listing Requirement Guides Isquare Intelligence

Bursa Listing Requirement Guides Isquare Intelligence

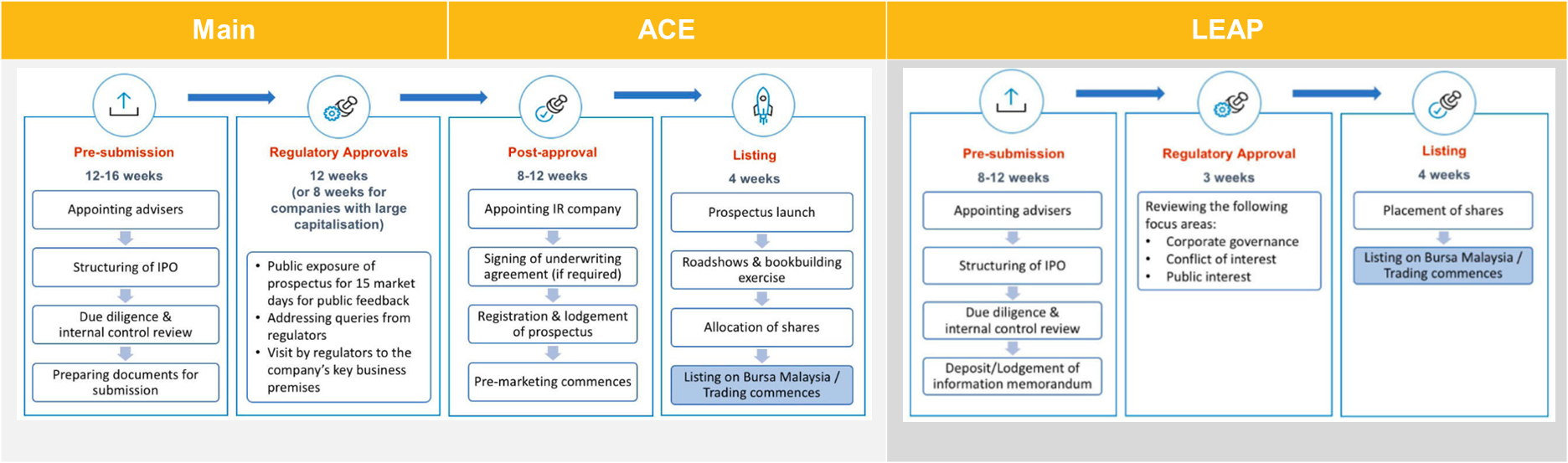

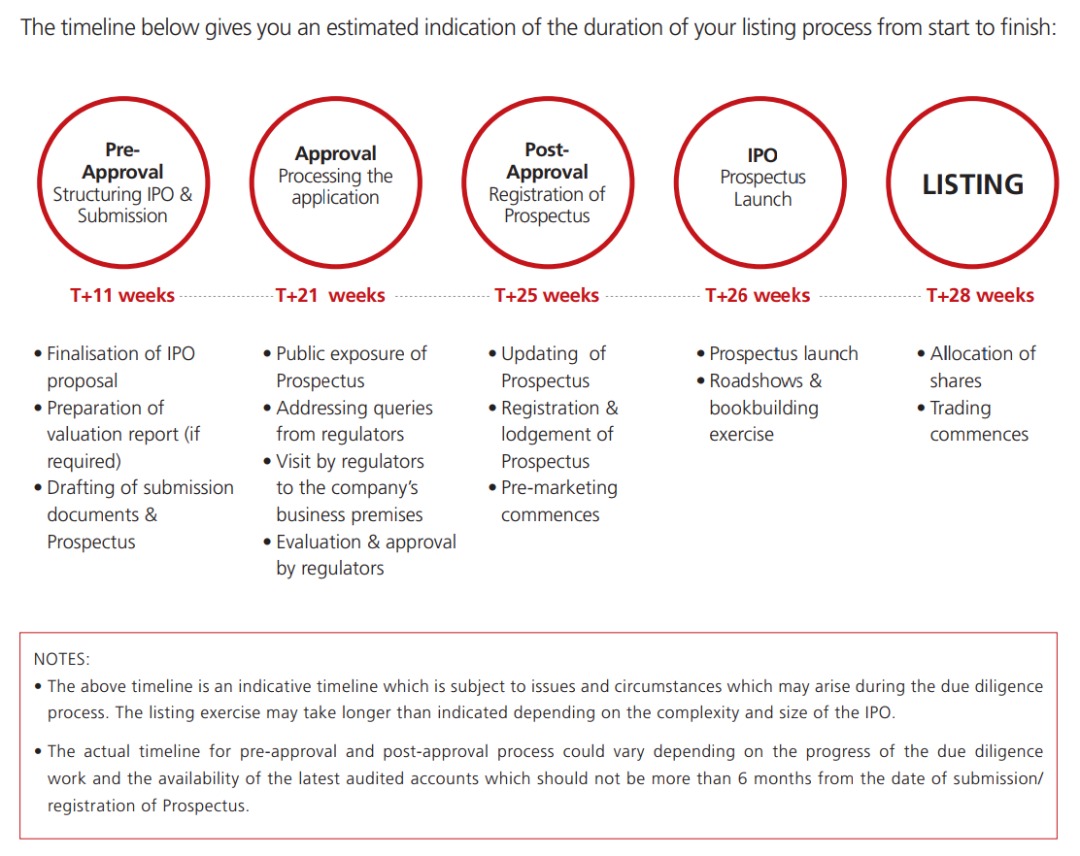

Listing Your Company On Bursa Malaysia Crowe Malaysia Plt

Do You Need To Understand Guidewire Certification And Its Requirements Sulekha Tech Pulse

Bursa Listing Requirement Guides Isquare Intelligence

Listing Your Company On Bursa Malaysia Ipos In 2021

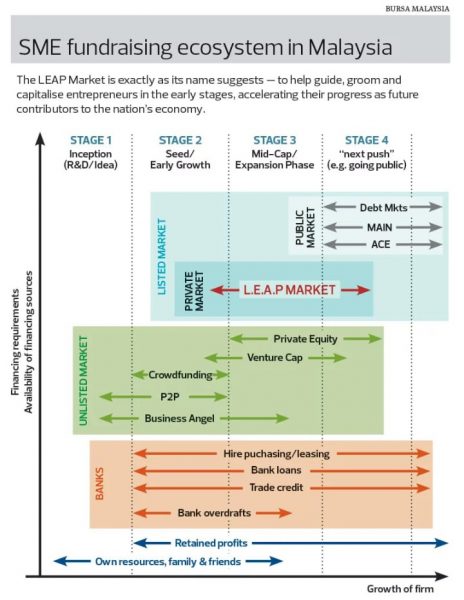

Leap Market One Year On The Edge Markets

Key Requirements For Listing On The Leap Market

What You Need To Know Listing At Bursa Malaysia Listing And The Requirements Hills Cheryl

Lead Story Leap Market Companies Ask For Clear And Seamless Transfer The Edge Markets

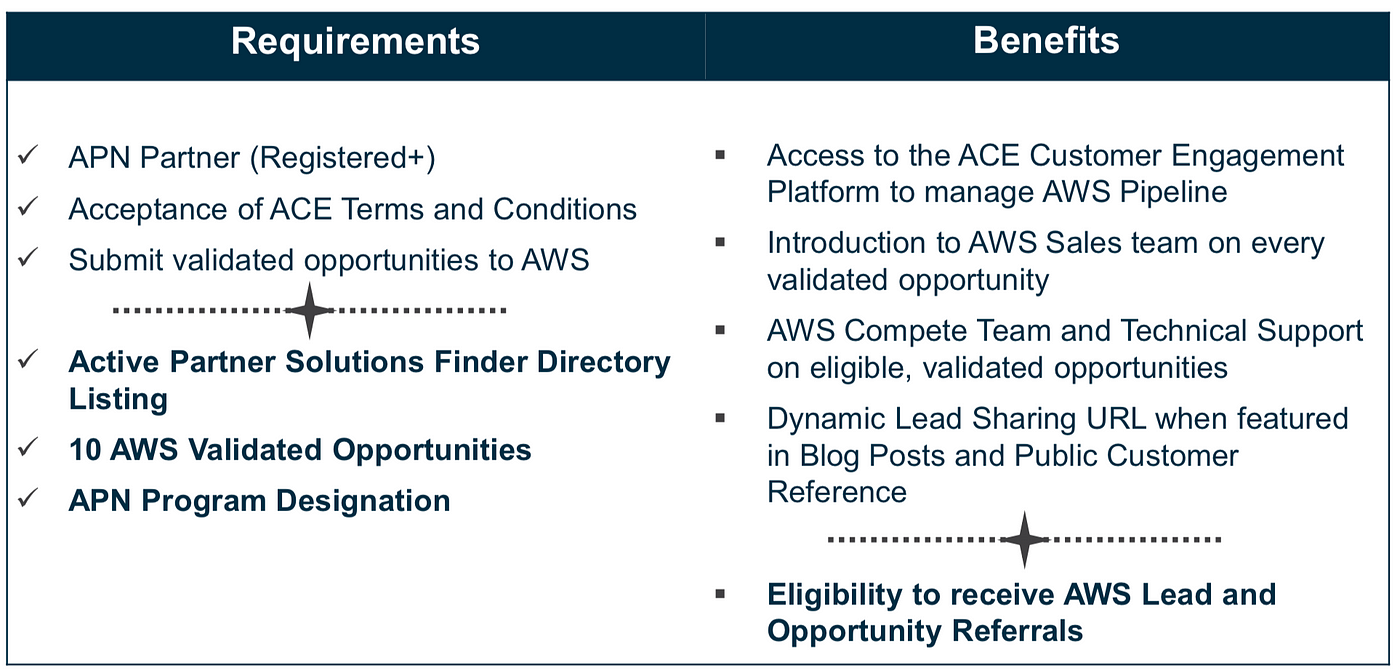

How To Co Sell With Aws 5 Ways To Drive Successful Customer Outcomes Using The Ace Program By Nofar Asselman Medium

What You Need To Know Listing At Bursa Malaysia Listing And The Requirements Hills Cheryl

Comments

Post a Comment